Contractor Insurance by State

Fast, Compliant, Nationwide Coverage

Nationwide Coverage Tailored to Your State

Looking for contractor insurance in your state? We make it easy. At Affordable Contractors Insurance (ACI), we offer tailored coverage that meets your state’s licensing laws and trade requirements.

We cover all 50 states—whether you’re a general contractor in California or an electrician in Florida, we’ve got you covered with nationwide support and local know-how.

We help you:

- Meet local licensing and bonding requirements

- Protect your crew, clients, tools, and reputation

- Get insured fast—with no phone tag or guesswork

Core Coverages Include:

- General Liability: Required in many states to protect against third-party injuries or property damage.

- Workers’ Comp: Mandatory in most states if you have employees.

- Commercial Auto: Covers vehicles used for hauling tools and materials between job sites.

- Surety Bonds: Many states require a bond for licensing or permitting.

Contracting businesses operate under different rules and risks depending on the state. At Affordable Contractors Insurance (ACI), we understand the state-specific requirements and regulations that contractors face. Our tailored policies help you stay compliant no matter where you work. Whether you’re roofing in Texas or framing houses in California, we’ve got you covered.

Why Choose State-Specific Coverage?

Contracting businesses operate under different rules and risks depending on the state. From licensing laws to jobsite hazards, you need insurance that keeps you compliant—and protects your crew, tools, and reputation. That’s why ACI offers:

- State-compliant policies for general and specialty contractors

- Fast, no-hassle quotes and same-day certificates

- Nationwide coverage, with local expertise

Don’t risk delays or fines—get insured with confidence.

We’ll help you meet your state’s requirements and protect your business

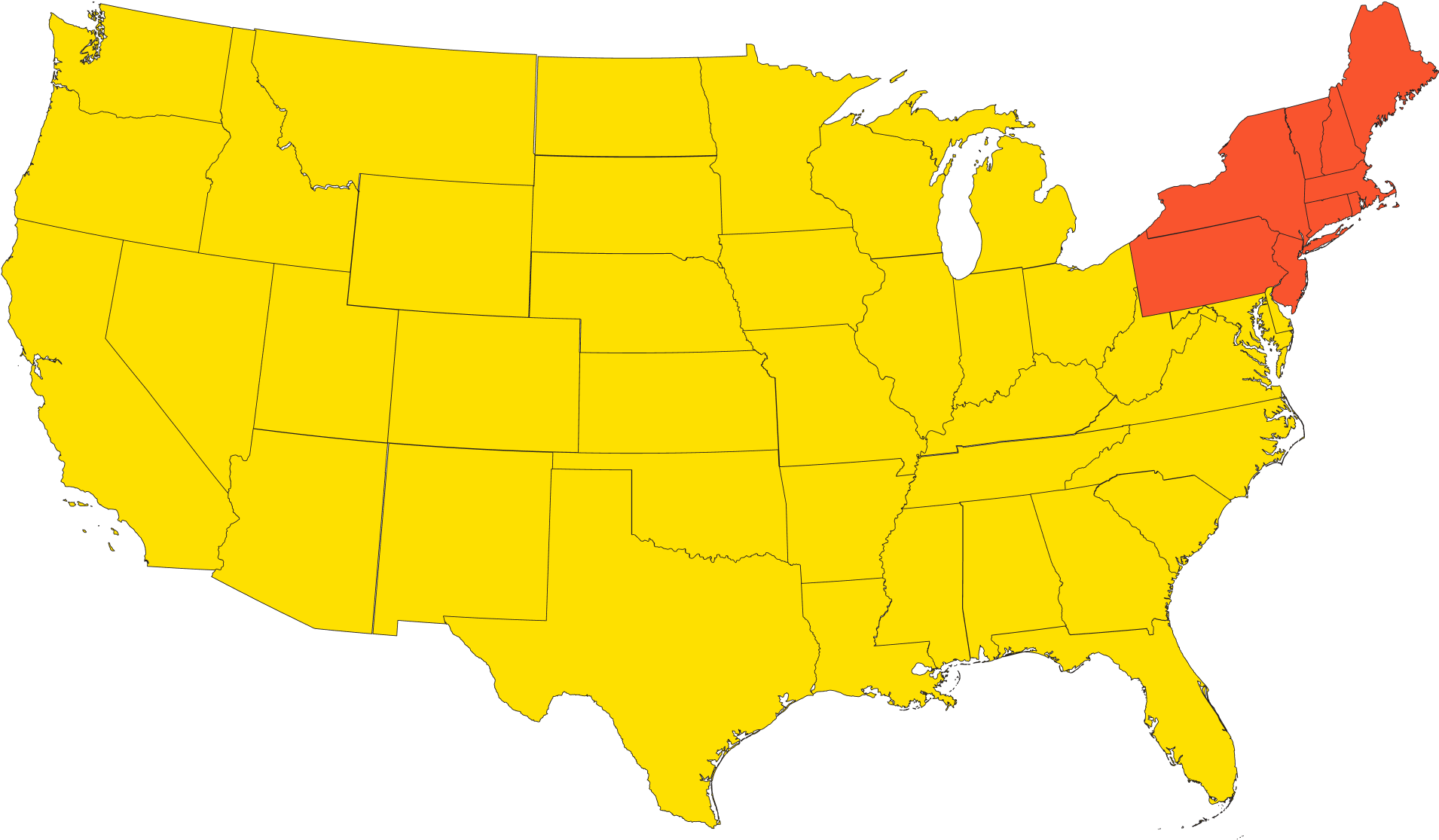

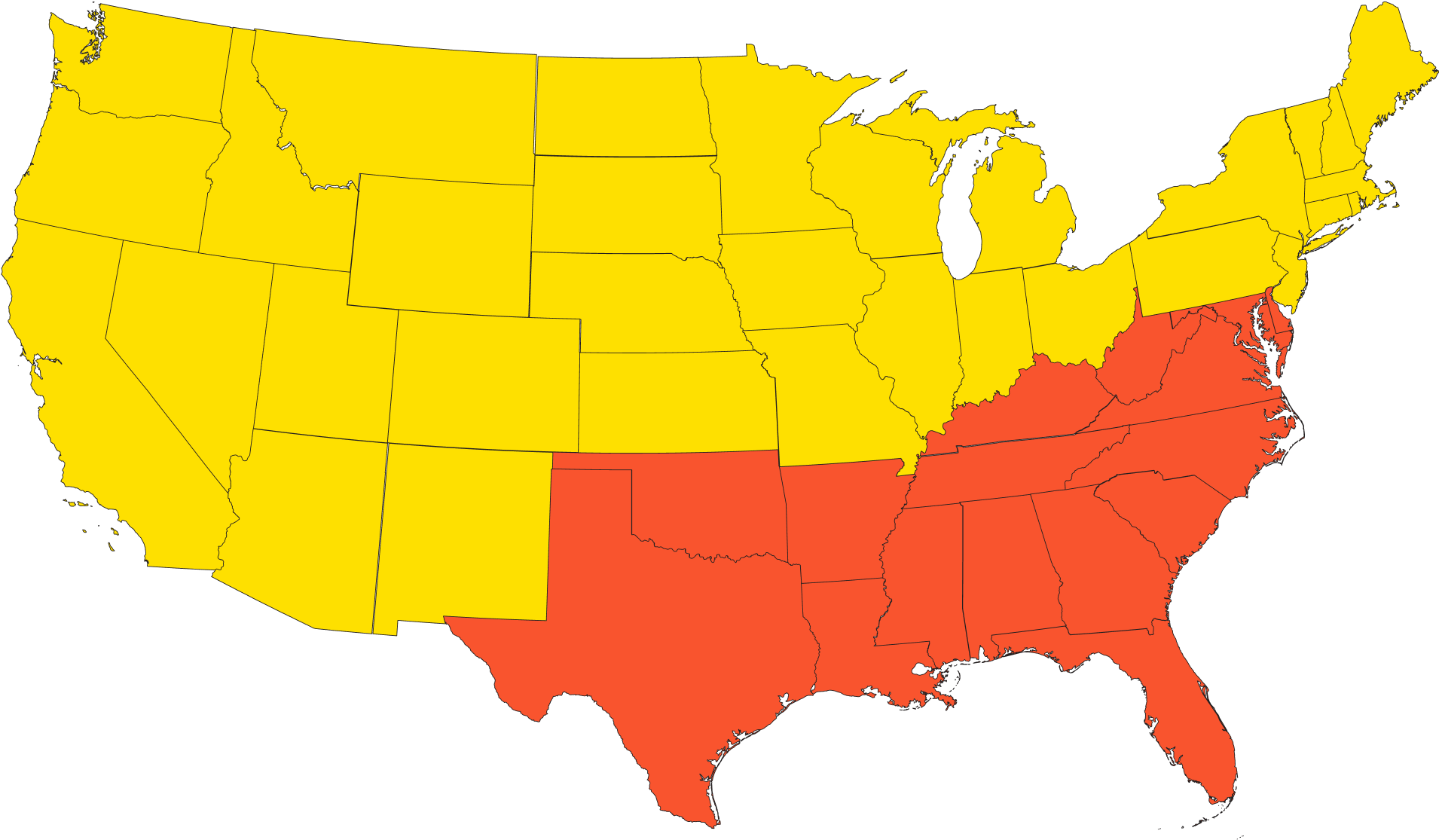

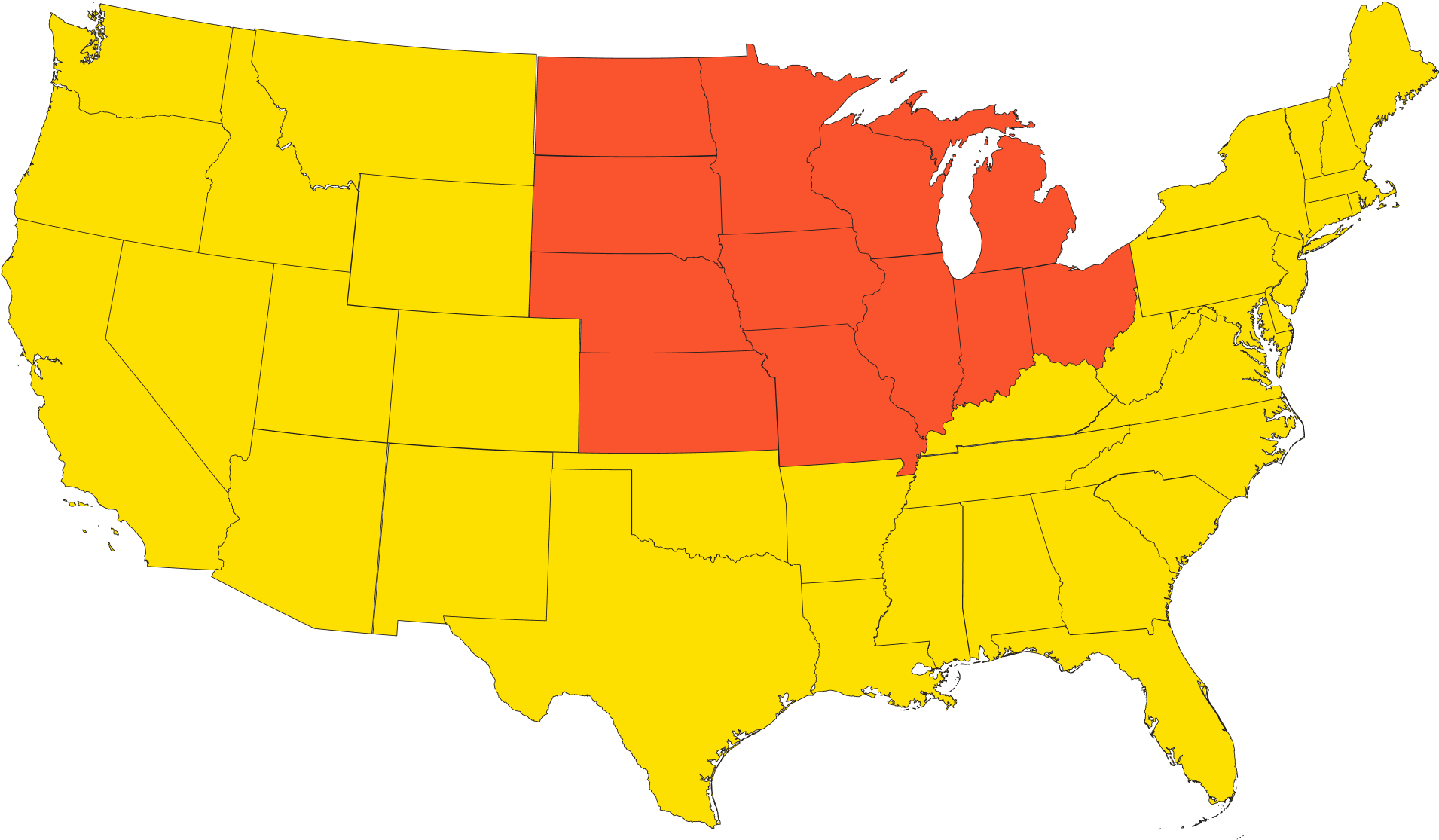

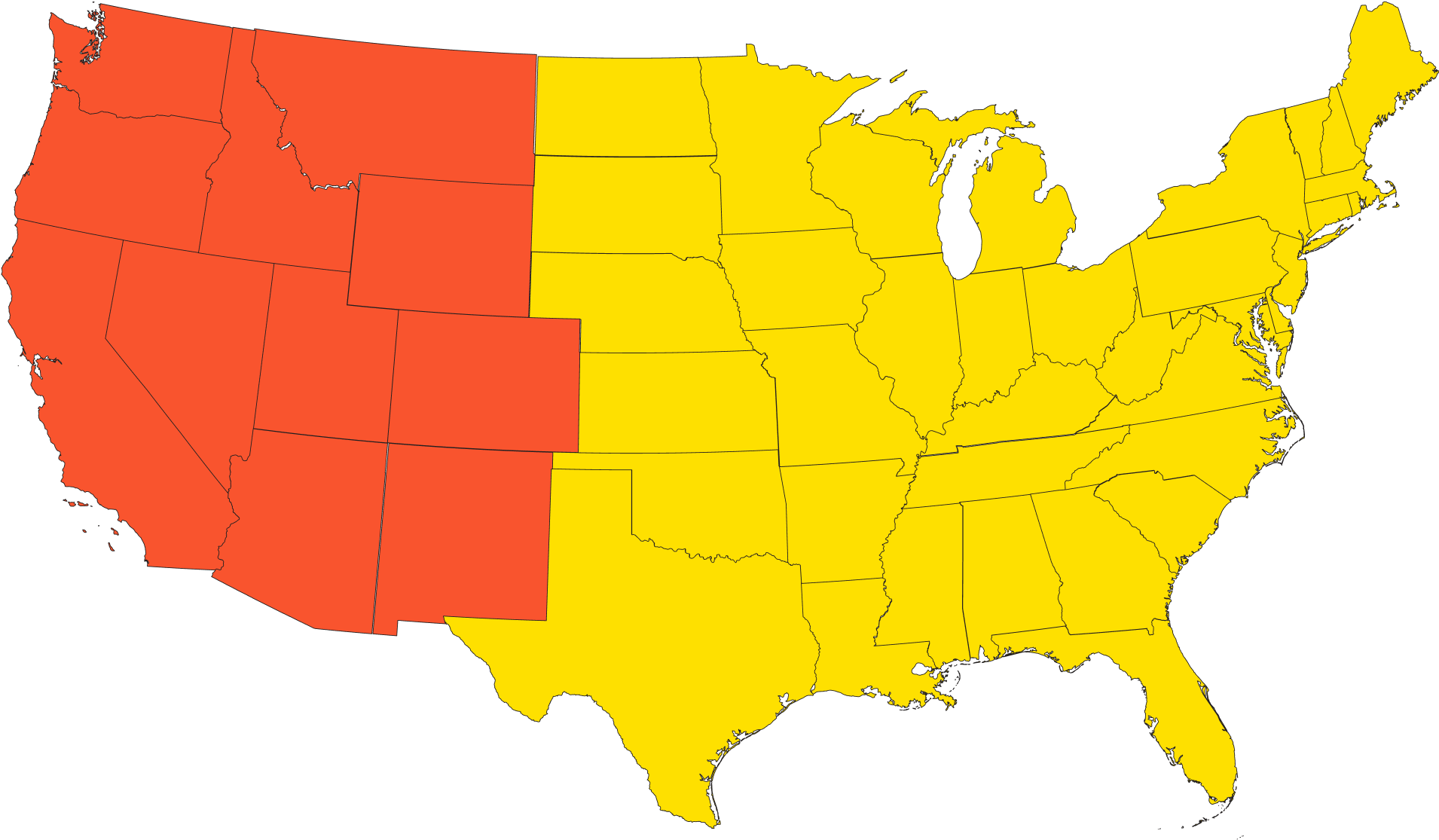

Explore Contractor Insurance by U.S. Region

Find Insurance in my state:

Find Insurance in my state:

Find Insurance in my state:

Find Insurance in my state:

Why State-Specific Expertise Matters

Avoid Compliance Issues

Meet state requirements to bid on jobs and avoid fines.

Stay Audit-Ready

We help you adjust coverage to meet audit standards.

Expand Without Worry

Grow your business into new states with policies ready to go.

The ACI Difference

At ACI, we specialize in making compliance simple. Our expert agents understand the unique requirements of each state and will build a policy to fit your location and industry. With nationwide access to certificates, you can start jobs without delays.

Frequently Asked Questions

We know insurance can feel complicated. That’s why we’ve compiled answers to the questions we hear most often from contractors like you. At ACI, our goal is to make insurance simple, fast, and reliable, so you can focus on your work without worrying about coverage.

1. Why does contractor insurance vary by state?

Each state sets its own laws for contractor licensing and insurance. Requirements can include general liability, workers’ comp, and surety bonds.

2. How do I know what insurance I need in my state?

Click your state above to see exactly what’s required and recommended based on your trade.

3. Can I get covered today?

Yes. Most policies can be bound the same day you apply, and we can issue certificates within minutes.

4. What if I work in multiple states?

No problem. We’ll help you build a policy that covers projects across state lines and keeps you compliant wherever the job takes you.

WhaT Our Clients Say

Workers Compensation Insurance by State

Get Affordable Coverage Near You

Whether you’re framing new homes or managing commercial builds, we’ll help you find the right policy—fast. No phone tag, no guesswork.