Affordable Contractors Insurance (ACI)

Affordable Contractors Insurance (ACI) specializes exclusively in the construction industry. ACI agents can help you select the right coverage for your company among the plethora of commercial insurance products. You never need all the products, but you will need a knowledgeable insurance agent, like the ones at ACI , to determine what is the right coverage for your business.

Commercial Insurance

Commercial insurance is a term that covers a variety of policies. As the owner of a construction company, your insurance choices are driven by what you’re mandated to have and what you need to ensure a successful risk management strategy.The most common insurance policies purchased by construction companies are: workers’ compensation, general liability, commercial property and builders risk.

Workers Compensation

Workers compensation is a form of insurance mandated by most states. It covers workers when they are injured on the job. This type of insurance pays for the medical treatment for the worker and includes hospitalization, surgery and physical therapy. Workers’ compensation also provides a monetary salary replacement to the injured parties to compensate them for lost wages.

General Liability

General liability, commercial insurance, protects the insurer from a wide variety of third party claims. Third party refers to the fact that the insurance does not apply to the party that bought it.

General liability covers you in five areas:

- Commercial Property Insurance

The Small Business Administration defines commercial insurance for property:

“Property insurance covers everything related to the loss and damage of company property due to a wide-variety of events such as fire, smoke, wind and hail storms, civil disobedience and vandalism. The definition of “property” is broad, and includes lost income, business interruption, buildings, computers, company papers and money.

Property insurance policies come in two basic forms: (1) all-risk policies covering a wide-range of incidents and perils except those excluded in the policy; (2) peril-specific policies cover losses from only those perils specified by the commercial insurance purchaser of a property policy.”

Builders Risk Insurance

A builder risk policy is a type of commercial insurance that covers your losses on new construction except for excluded items. Incidents like floods or earthquakes would not be covered unless a rider were put on the policy to include these types of events.

Builder’s risk insurance is usually purchased by the builder. However, common law states that once a property has had improvement done on it, it belongs to the owner. Because of that law, in some cases the owner will take out the builder’s risk insurance.

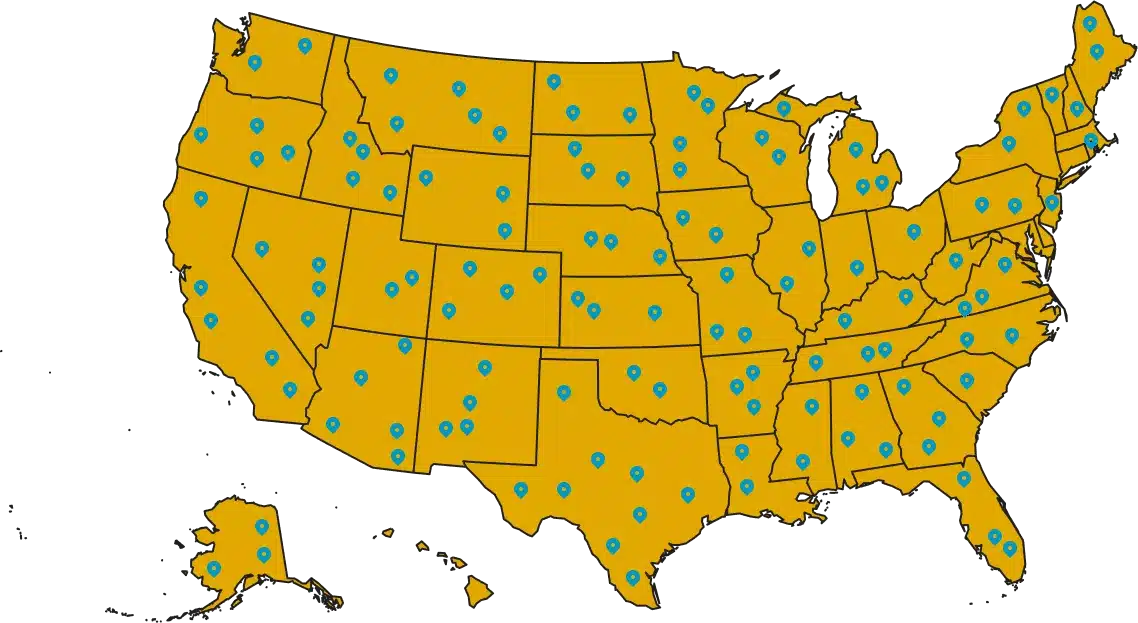

ACI Agents

You need a professional, who is well-versed in the construction industry. ACI agents meet that standard and can help you determine what commercial insurance coverage you require.