Florida Contractors: Coverage That Works for You

Get a free quote today

Need Florida Roofers Insurance Coverage?

Roofing can be a rewarding business, but it’s not without risks. To protect your workers and your company as a whole, you need quality insurance coverage. The right insurance protects your company, your workers, your tools, and even your reputation.

Best of all, the right coverage doesn’t have to be expensive. Affordable Contractors Insurance can help you find thorough Florida roofers insurance coverage to give you peace of mind — all for a low price!

Residential Roofing Insurance in Florida

If your company primarily works on residential properties, you need a residential-specific policy. Generally speaking, damage to residential properties is less expensive than damage to commercial properties, so premiums and policy limits tend to be lower.

With that being said, when you’re choosing a residential roofing insurance policy, don’t make the mistake of only trying to get the lowest monthly premium you can! Very cheap insurance policies often offer limited coverage, high deductibles, and low policy limits.

High-deductible insurance policies can leave you high and dry in the event of damage to a customer’s property. A deductible is the amount you pay before insurance covers the rest. The higher the deductible, the more you end up paying out of pocket.

Policy limits set the maximum amount your insurance provider will pay. Let’s say something goes horribly amiss and you cause $200,000 worth of damage to a customer’s home. If your policy limit is $100,000, you’ll be stuck paying the remaining $100,000 out of pocket.

In many cases, it’s wise to get more coverage than the required minimum. When customers see you have a high policy limit, they’ll know that you take the responsibility of working on their home seriously.

Commercial Roofing Insurance in Florida

If you and your company work on commercial properties, you will need separate commercial insurance. Commercial roofing insurance will generally cost more, as commercial damages can be incredibly expensive. As a result, most commercial policies can cover millions in damages:

- Most have a $1 million cap

- They also usually have a $2 million umbrella policy

- If you’re working on a larger building, you may need an umbrella policy of up to $5 million

The exact coverage you need for a commercial policy is typically set by the property owner. Before agreeing to a contract, make sure to carefully review the required policy minimums.

In some cases, you may get a contract that requires more coverage than you have. At ACI, we can help you upgrade your coverage quickly and easily. Our experienced agents will be able to review your contract requirements and find you a policy that meets or exceeds them.

Find the Best Policy for You

Whether you’re looking to purchase your first Florida roofing contractor insurance policy or you have purchased insurance before, it can be very difficult to know what you need in a policy (and what you don’t).

But at Affordable Contractors Insurance, our knowledgeable agents have a deep understanding of the roofing industry and the insurance industry. We can take a careful look at your business, help you decide what types of coverage you need, and find you the right policy for a great price. Contact us today for a free quote for Florida roofers insurance!

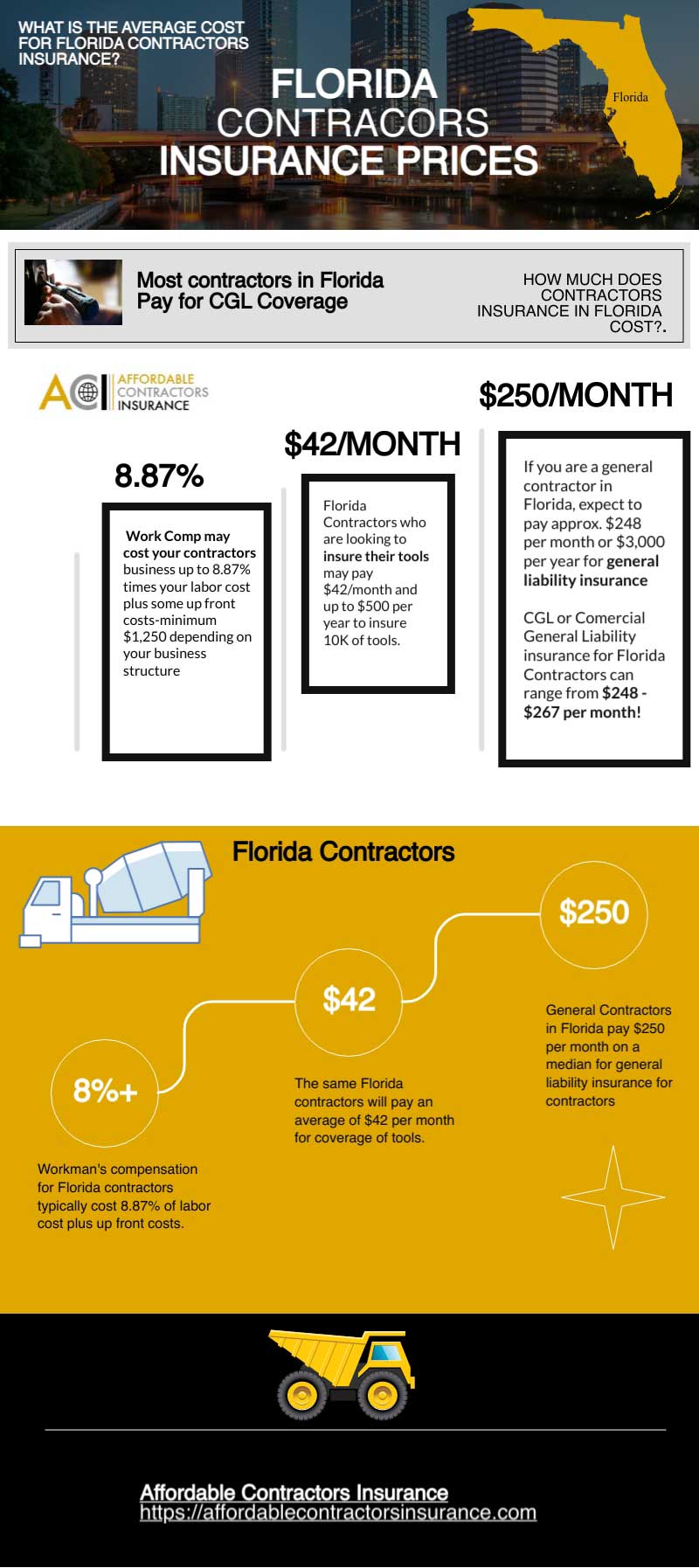

General Contractors’ Insurance Pricing Near Florida

Looking to find the best prices for contractors insurance in Florida. At Affordable Contractors Insurance, we provide the best prices for Florida construction business insurance coverage. The average median price for your general liability coverage ranges from $248 to $325 per month & up to $3,000+ per year. These prices may vary depending on the type of contractors insurance in Florida you need. For example to insure your tools may cost Florida contractors from $41 to $65 per month or $500 and up per year.

Here is a quick Florida Contractors Insurance breakdown to help you understand the price to insure your construction business in Florida.

| Type of Insurance: | Low Price Monthly: | High Price Monthly: | Insurance Coverage: | Required: |

|---|---|---|---|---|

| General Liability | $248 | $325 | Bodily Injury - Property Damage - Faulty Work Damage Can Be Covered. | YES |

| Contractors Tools Protection | $41 | $65 | Company Tools | NO |

| Workman's Comp. | 8.86 - 8.89% x Roofing Labor Costs | 8.86% to 8.89% x Labor Cost = $1,250 to $1,500 Additional | Workers compensation typically will cover your construction workers medical bills or lost wages from on the job accidents. | YES |

| Tricks for Florida Contractors: If you are interested in using drones to do building inspections, keep in mind insurance for this is typically not included in the contractors general liability policy. | ||||

Finding the right general contracting insurance in Florida can be a challenge, especially if you haven’t had to insure a business before. But whether you work in Jacksonville, Miami, Tampa, or anywhere else across the state, Affordable Contractors Insurance can help you get the coverage you need.

Why Do You Need Construction Business Insurance?

You might think that your company will never face a personal injury lawsuit or a lawsuit over property damage. However, even the most careful contractors make mistakes.

Even if you’re eventually found to not be at fault, legal battles over claims can become incredibly expensive. You’ll need to handle court costs and attorney fees. If a judge determines that your company is at fault, you’ll need to pay any settlement out of pocket. In some cases, a single settlement is enough to ruin a business.

Fortunately, contractors insurance can protect you from financial disasters like these.

When you have insurance, your insurer can pay for legal costs and settlements in the event of a claim. You can also purchase insurance to protect your tools, materials, company vehicles, workers, and more.

What Types of Florida General Contractors Insurance Do You Need?

There are several different types of contractors insurance, and your business may or may not need all of them. Here are some of the most common insurance types chosen by contractors:

- General Liability: Covers claims of bodily injury or property damage caused by your company; also covers claims of defamation through advertising

- Workers’ Compensation: Pays for medical care and compensates for lost wages if an employee is injured

- Builders Risk: Protects buildings or projects under construction or renovation

- Errors and Omissions (E&O): Protects you if a customer claims you performed faulty work

- Commercial Auto: Covers your work vehicles if they cause or sustain damage

- Pollution Liability: Covers damage and injury claims related to your company’s disposal of toxic waste

- Inland Marine: Protects your building materials as they are being transported over land

- Subcontractor Default (SDI): Protects you if one of your subcontractors does not complete a project or performs faulty work

At a minimum, contractors should carry general liability and workers’ compensation insurance. Different regions and cities may also have their own insurance requirements. For example, the insurance requirements for contractors in Orlando may be different from those in St. Petersburg.

If you aren’t sure what types of insurance you need, our knowledgeable agents are happy to help.

Let ACI Be Your Guide to Florida Contractors Insurance

At ACI, our mission is to provide affordable insurance for construction companies in Florida and beyond. We only work with contractors, so we’re able to understand the unique needs of contractors and help you find the best protection for the best price. Contact us today for your free, no-obligation quote!