Contractors Insurance Prices in Arizona

No matter how careful you are, it’s possible that you or one of your employees could make a mistake on the job. And as some contractors have discovered, making a mistake while being uninsured may prove to be disastrous.

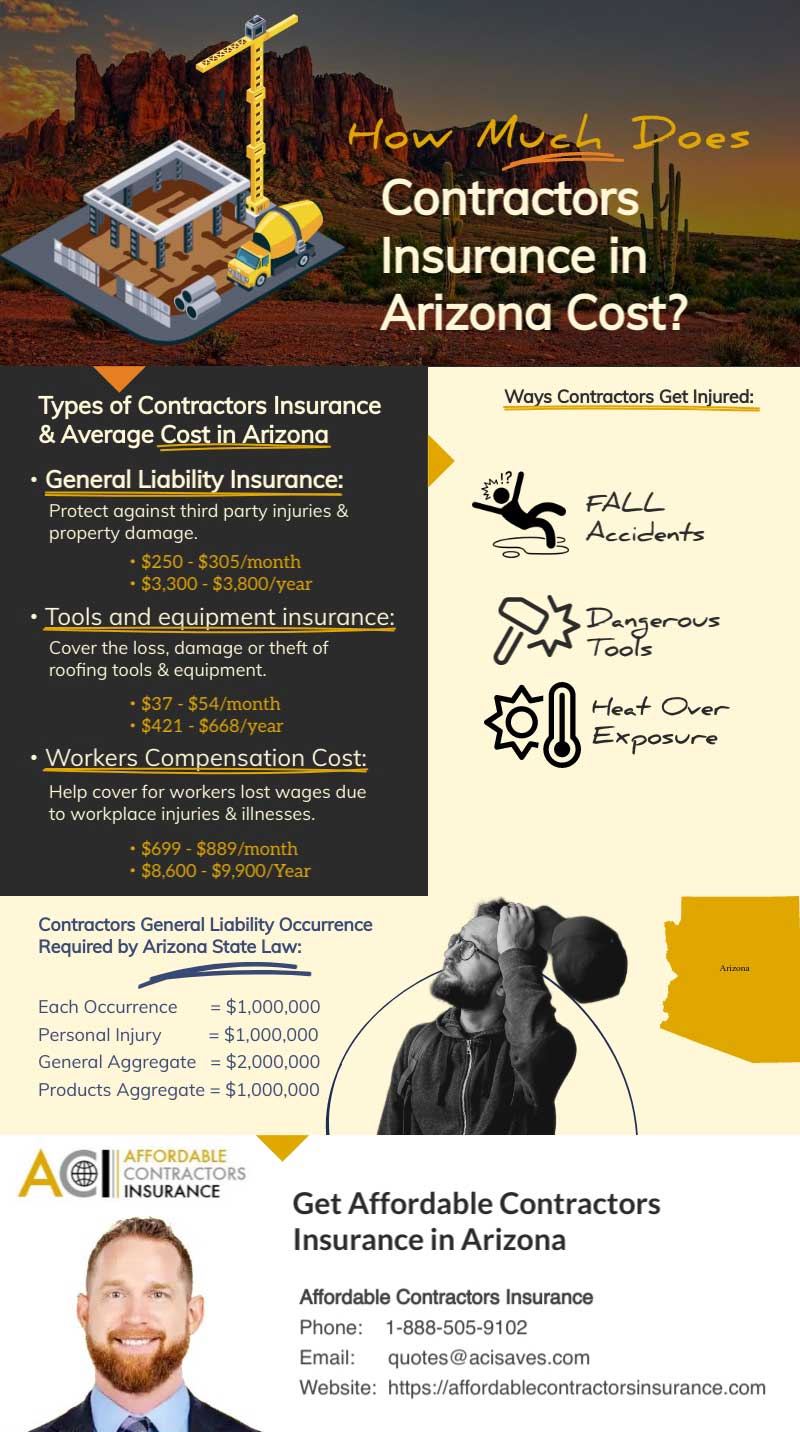

- $3,000/year or $250/month for decent policy +/- depending on size of company and features selected

- Tools-$10k of misc tools about $500/year add on or $42/month add on to GL

- Work Comp-8.87% times your roofing labor cost plus some up front costs-minimum $1,250 depending on your business structure

| Insurance Coverage Type: | Low Monthly Cost | High Monthly Cost | What is covered in my insurance policy? | Is this type insurance required for Arizona Contractors? |

|---|---|---|---|---|

| Liability for Contractors | $250 | $310 | Bodily injury to you or your construction workers, Property Damage | YES |

| Contractors Tools 10K in Coverage | $42 | $55 | Construction tools lost, stolen or damaged. | NO |

| Workers Comp | Up to 8.87% x your contractors labor. | 8.87% x contractors labor plus up front cost of a minimum $1,250 | Employees lost wages and medical bills due to on the job accidents. | YES |

| Tips & Tricks for Arizona Contractors Insurance cost: If you are planning on using a drone for your construction business to do inspections NOTE: Drone protection is typically NOT included in a contractors general liability insurance policy. | ||||

You’ve worked hard to build your business. Let ACI work hard to protect it with the right contractors insurance.

Arizona Contractors Insurance Cost: The Essentials

There are seemingly endless types of insurance for construction companies in Arizona. But whether you work in Phoenix, Tucson, Mesa, or a smaller area, it’s essential to have two types of insurance — workers’ compensation and general liability.

Workers’ compensation is designed to protect your employees against injury. If an employee suffers an injury on the job, your insurance will cover their medical bills. It also will pay for any wages lost due to the injury.

General liability insurance protects your company against a variety of claims. If a customer or another third party files a claim of property damage or bodily injury against you, your insurance will cover costs associated with the claim, including court costs, attorney fees, and any settlement ordered by a judge.

Before buying a workers’ compensation or general liability policy, make sure you understand the policy limits required by law. Depending on whether you primarily work in Chandler, Gilbert, or elsewhere, you may find that different areas have different insurance requirements.

Other Types of Insurance to Consider

If you’re shopping for general contracting insurance in Arizona, you’ll soon find that there are many more types of policies to consider. Some of these are other forms of liability insurance:

- Professional Liability Insurance/Errors and Omissions (E&O) Insurance: Protects you from liability if a customer claims you made a mistake

- Wrap Insurance: Complete liability coverage for everyone working on one project or multiple projects

- Subcontractor Default Insurance: Protects you if one of your subcontractors violates a contract by failing to perform work or by performing faulty work

- Pollution Liability Insurance: Covers you if a third party claims you have violated environmental protection laws

Other types are designed to protect your company’s property or projects:

- Commercial Auto Insurance: Covers work vehicles in the event of damage

- Builders Risk Insurance: Protects any buildings that are being constructed or renovated

- Inland Marine Insurance: Covers any building materials that are being transported

- Commercial Building Insurance: Protects offices, storage buildings, and any other buildings your business owns

Whether this is your first insurance policy or the latest of many, deciding which type of policy to get can be a confusing, often overwhelming decision. Choosing the right insurance is an essential part of risk management, and it often involves a careful risk-benefit analysis.

The good news is that you don’t have to do that risk-benefit analysis on your own. When you work with ACI, our experienced agents can talk to you about your business to help you decide which types of coverage you need.

Find Affordable Contractors Insurance Cost in Arizona

Purchasing Arizona general contractors insurance is one of the most important investments you can make in your business. Don’t take this step with just any insurance company!

At Affordable Contractors Insurance, we only insure contractors. Our agents understand both the world of contracting and the world of insurance. We can help you find the right policy for your business at a great price. Contact us today for your free quote.